General

Certain information concerning our executive officers as of the date of this proxy statement is set forth below. Officers are elected annually by the Board and serve at the discretion of the Board.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information with respect to the compensation of each of the named executive officers for services provided in all capacities to Takung Art Co., Ltd and its subsidiaries, HongKongHong Kong Takung Assets and Equity of Artworks ExchangeArt Co., Ltd, Hong Kong Takung Art Holdings Co., Ltd, Takung (Shanghai) Co., Ltd, and Takung Cultural Development (Tianjin) Co., Ltd.Ltd, Art Era Internet Technology (Tianjin) Co., Ltd, Hong Kong MQ Group Limited and Tianjin MQ Enterprise Management Consulting Co., Ltd in the fiscal years ended December 31, 20162020 and 20152019 in their capacity as such officers. Mr. Chun Hin Leslie Chow, our chief financial officer received no additional compensation for his services as chief financial officer of HongKong Takung Assets and Equity of Artworks Exchange Co., Ltd. Mr. LiMing Cheng receives no additional consideration for his services as director of the Company. No other executive officer or former executive officer received more than $100,000 in compensation in the fiscal years reported.

| Name and Principal | Fiscal | Salary | Bonus | Stock Options* | Non-Equity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | All Other Compen-sation | Total | ||||||||||||||||||||||||

| Position | Year | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||||

| Di Xiao | 2016 | 193,533 | 60,551 | 51,346 | - | - | - | 305,430 | ||||||||||||||||||||||||

| Chief Executive Officer and Director (1) | 2015 | 37,162 | 4,645 | - | - | - | - | 41,807 | ||||||||||||||||||||||||

| Chun Hin Leslie Chow (2) | 2016 | 172,064 | 45,100 | 61,310 | - | - | - | 278,474 | ||||||||||||||||||||||||

| Chief Financial Officer | 2015 | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Zishen Li (3) Vice President, Hong Kong Takung | 2016 | 75,944 | 13,785 | - | - | - | - | 89,729 | ||||||||||||||||||||||||

| General Manager, Shanghai Takung and Tianjin Takung | 2015 | - | - | - | - | - | - | - | ||||||||||||||||||||||||

Summary Compensation Table

| Name & Principal Position | Fiscal Year | Base Compensation (annual, unless otherwise noted) | Bonus | Share Options * | Total Annual | |||||||||||||||

| Kwok Leung Li(1) | 2020 | — | — | — | — | |||||||||||||||

| Chief Executive Officer | ||||||||||||||||||||

| Zhirong Li(2) | 2020 | — | — | — | — | |||||||||||||||

| Chief Financial Officer | ||||||||||||||||||||

| Wing Yan Leung(3) | 2020 | — | — | — | — | |||||||||||||||

| Former Chief Financial Officer | ||||||||||||||||||||

| Zhihua Yang(3) | 2020 | $ | 23,402 | $ | — | — | $ | 23,402 | ||||||||||||

| Former Chief Executive Officer | 2019 | $ | — | $ | — | — | $ | — | ||||||||||||

| Jing Wang(4) | 2020 | $ | 32,056 | $ | — | — | $ | 32,056 | ||||||||||||

| Former Chief Financial Officer | 2019 | $ | — | $ | — | — | $ | — | ||||||||||||

| Fang Mu(5) | 2020 | $ | 45,127 | $ | — | — | $ | 45,127 | ||||||||||||

| Former Chief Executive Officer | 2019 | $ | 38,687 | $ | 5,984 | — | $ | 44,671 | ||||||||||||

| Jehn Ming Lim(6) | 2020 | $ | 41,904 | $ | $ | 41,904 | ||||||||||||||

| Former Chief Financial Officer | 2019 | $ | 90,367 | $ | 7,605 | — | $ | 97,972 | ||||||||||||

| Chun Hin Leslie Chow(7) | 2020 | $ | — | $ | — | — | $ | — | ||||||||||||

| Former Chief Executive Officer, Former Chief Financial Officer | 2019 | $ | 121,561 | $ | — | — | $ | 121,561 | ||||||||||||

| Mr. Kwok Leung Li was appointed as our Chief Executive Officer on July 20, 2021. He received no compensation in fiscal years 2020 and 2019. | ||

| (2) | Ms. Zhirong Li was appointed as our Chief Financial Officer on December 3, 2021. She received no compensation in fiscal years 2020 and 2019. | |

| (3) | Ms. Leung was appointed as our Chief Financial Officer on July 20, 2021 and resigned on December 3, 2021. She received no compensation in fiscal years 2020 and 2019. | |

| (4) | Ms. Yang was appointed as our Chief Executive Officer on September 22, 2020 and resigned on July 20, 2021. | |

| (5) | Ms. Wang was appointed as our Chief Financial Officer on May 26, 2020 and resigned on September 30, 2021. | |

| (6) | Ms. Mu was appointed as the Company’s Chief Executive Officer on August 6, 2019 and resigned on September 5, 2020. |

| On August 14, 2019, Ms. Mu entered into a consulting agreement with our indirect wholly-owned subsidiary, Takung Cultural Development (Tianjin) Co., Ltd to provide management services, consulting services to clients, administration and human resources management and financial and accounting management services. In consideration for her services, Ms. Mu will be paid RMB 30,000 (approximately $4,345) per month on an after-tax basis and be reimbursed for all incidental expenses. The term of her engagement will be for an initial period of one year beginning August 14, 2019 through August 13, 2020 and will automatically renew for successive one (1) year periods unless terminated by either party. The consulting agreement was approved by our Audit Committee on August 12, 2019. |

| The |

| (6) | On February 18, 2019, our |

| Mr. Chow was appointed our Chief Financial Officer and Chief Financial Officer of our Hong Kong subsidiary, |

| On November 16, 2018, Mr. |

| *The value reported for each executive is |

Narrative to Summary Compensation Table

In fiscal year 2016,2020, the primary components of our executive compensation programs were base salary and equity compensation.salary. We use base salary to fairly and competitively compensate our executives, including the named executive officers, for the jobs we ask them to perform.

It is not uncommon for Hong Kong private companies to have base salaries as the sole form of compensation. We view base salary as the most stable component of our executive compensation program, as this amount is not at risk. We believe that the base salaries of our executives should be targeted at or above the median of base salaries for executives in similar positions with similar responsibilities at comparable companies, consistent with our compensation philosophy. We have formed a compensation committee to oversee the compensation of our named executive officers. All the members of the compensation committee are independent directors. The compensation committee reviews and plans to adopt in 2017 a more formal bonus plan. The committee has the discretion to review and approve each employee’s bonus.

Operating Subsidiary Executive Compensation Summary

The table below sets forth the positions and compensations for the officers and sole director of Hong Kong and Tianjian Takung for the years ended December 31, 20162020 and 2015.2019.

| Name and Principal | Fiscal | Salary | Bonus | Stock Options* | Non-Equity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | ||||||||||||||||||||||||

| Position | Year | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||||

| Di Xiao | 2016 | 193,533 (2) | 60,551 | - | - | - | - | 254,084 | ||||||||||||||||||||||||

| Managing Director | 2015 | 86,711 | (1) | 10,839 | - | - | - | - | 97,550 (1) | |||||||||||||||||||||||

| Chun Hin Leslie Chow | 2016 | 172,064 | 45,100 | - | - | - | - | 217,164 (3) | ||||||||||||||||||||||||

| Chief Financial Officer | 2015 | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Name | Fiscal Year | Annual Salary ($) | Bonus ($) | Total ($) | ||||||||||||

| Leslie Chow 1 | 2020 | - | - | - | ||||||||||||

| Former Chief Executive Officer, former Chief Financial Officer | 2019 | 121,561 | - | 121,561 | ||||||||||||

| Jehn Ming Lim 2 | 2020 | 41,904 | - | 41,904 | ||||||||||||

| Former Chief Financial Officer | 2019 | 90,367 | 7,605 | 97,972 | ||||||||||||

| Fang Mu 3 | 2020 | 45,127 | - | 45,127 | ||||||||||||

| Former Chief Executive Office | 2019 | 38,687 | 5,984 | 44,671 | ||||||||||||

| Song Wang 4 | 2020 | - | - | - | ||||||||||||

| Former Director | 2019 | 28,175 | - | 28,175 | ||||||||||||

| (1) | Mr. |

| (2) | Mr. Lim’s compensation as Chief Financial Officer of both the Company and its Hong Kong subsidiary is set forth in an employment agreement between Mr. Lim and Hong Kong Takung dated February 18, 2019. Pursuant to the agreement, Mr. Lim received a monthly salary of HK$65,000 (approximately $8,296) for his services as Chief Financial Officer. Mr. Lim resigned his position of Chief Financial Officer on May 9, 2020. |

| (3) |

The table below sets forth the positions and compensations for the General ManagerRMB 30,000 (approximately $4,345) per month. Ms. Mu resigned her position as an officer of Shanghai Takung and Tianjin for the years ended December 31, 2016 and 2015.

| Zishen Li | 2016 | 75,944 (1) | 13,785 | - | - | - | - | 89,729 | (1) | |||||||||||||||||||||||

| Managing Director | 2015 | - | - | - | - | - | - | - |

| (4) | Mr. Wang received a monthly compensation of $3,868 (HKD$ |

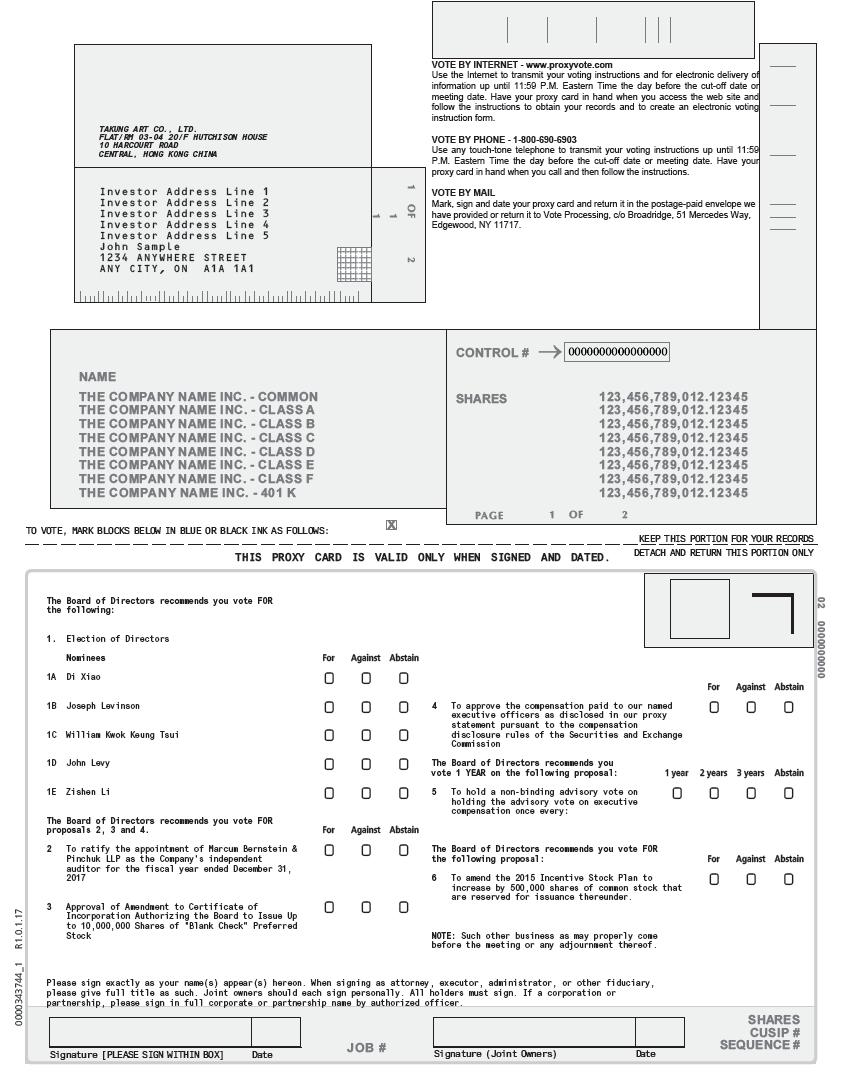

2015 Incentive Stock Option Plan

On August 26, 2015, the 2015 Incentive Stock Plan (“2015 Plan”) was approved by the Board of Directors for rewarding the Company’s directors, executives and selected employees and consultants for making major contributions to the success of the Company. 1,037,000 shares were registered on August 27, 2015.

Option Grants Table

During the yearyears ended December 31, 2016,2020 and 2019, the Company granted an aggregate of 431,525 stockdid not grant new share options under the 2015 Plan. 268,600 were granted effective on February 2, 2016, 50,000 were granted effective on February 29, 2016 and 112,925 of the options were granted effective on March 30, 2016. In addition, on December 1, 2015 and March 1, 2016, 12,143 and 7,463 of restricted stock-based awards were granted. Each of the awards is subject to service-based vesting restrictions. The February 2, 2016 grant included a grant of 50,000 shares to a non-employee who became an employee on March 2, 2016.

The exercise price of stock options ranged from $2.91 to $3.65 and the requisite service period ranged from two to five years. 33,333 stock options have been vested and 3,000 stock options were cancelled during year ended December 31, 2016, and no stock options were exercised or cancelled ended December 31, 2015.

Option Grants Table

During the year ended December 31, 2016, the Company granted an aggregate of 431,525 stock options under the 2015 Plan. 268,600, including a grant of 50,000 shares to a non-employee who became an employee on March 2, 2016, were granted effective on February 2, 2016, 50,000 were granted effective on February 29, 2016 and 112,925 of the options were granted effective on March 30, 2016.

Outstanding Equity Awards at Fiscal Year-End

During year ended December 31, 2016, 7,4632019, 5,000 of restricted stock-basedshare-based awards were granted. Each of the awards is subject to service-based vesting restrictions. The total unvested restricted stockshare was 1,244Nil shares as of December 31, 2016.2019.

During year ended December 31, 2020, 10,000 restricted share-based awards were granted. Each of the awards is subject to service-based vesting restrictions. The total unvested restricted shares Nil shares as of December 31, 2020.

Aggregated Option Exercises and Fiscal Year-End Option Value Table

33,333 stock80,534 share options have been vested and 3,000 stock153,348 share options were cancelledforfeited during the year ended December 31, 2016.2019. As of December 31, 2016,2019, the number of options outstanding and exercisable were 428,525100,890 and 33,33380,534, respectively.

90,712 share options have been vested and no share options were forfeited during year ended December 31, 2020. As of December 31, 2020, the number of options outstanding and exercisable were 100,890 and 90,712 respectively.

Long-Term Incentive Plan (“LTIP”) Awards Table

There were no awards made in the last completed fiscal year under any LTIP.

Pension and Retirement Plans

Currently, except for contributions to the PRC government-mandated social security retirement endowment fund for those employees who have not waived their coverage, we do not offer any annuity, pension or retirement benefits to be paid to any of our officers, directors or employees. There are also no compensatory plans or arrangements with respect to any individual named above which results or will result from the resignation, retirement or any other termination of employment with our company, or from a change in our control.

Operating Subsidiary Employment Agreements

Mr. XiaoMs. Mu, as Chief Executive Officer of the Company, entered into an employmenta consulting agreement with our wholly-owned subsidiary, Hong Kong Takung on June 1, 2014 whereby he agreed to serve as Hong Kong Takung’s General Managerprovide management services and Managing Director. Pursuant to such employment agreement, Mr. Xiao is entitled to a monthly salarythe effective day of $7,741 (HK$60,000), which will be reviewed annually in January. On March 2015, Mr. Xiao’s salary was adjusted to $10,323 (HK$80,000), and was adjusted to $12,883 (HK$100,000) on October 2015, and further adjusted to $15,460 (HK$120,000) on April 2016. The employment agreement may be terminated by either party upon one month’s advance notice.

Mr. Li has been a Vice PresidentAugust 6, 2019. Ms. Mu resigned her positions of Hong Kong Takung since March 1, 2015. He was subsequently appointed as the General Manager of Shanghai Takung and Tianjin Takung with effect from July 28, 2015 and January 27, 2016, respectively. The employment with Mr. Li can be terminated by either party by giving at least one month notice.

On February 22, 2016, the board of directors of the Company approved the appointment of Mr. Chow as the new Chief FinancialExecutive Officer of the Company and the Company’s wholly-ownedofficer of our subsidiary in Hong Kong subsidiary, HongKong Takung Assets and Equity of Artworks Exchange Co., Ltd, effective February 22, 2016. The employment agreement may be terminated by either party upon three months’ advance notice.on September 5, 2020.

Potential Payments Upon Termination or Change of Control

Under Chinese law, we may only terminate employment agreements without cause and without penalty by providing notice of non-renewal one month prior to the date on which the employment agreement is scheduled to expire. If we fail to provide this notice or if we wish to terminate an employment agreement in the absence of cause, as defined in the agreement, then we are obligated to pay the employee one month'smonth’s salary for each year we have employed the employee. We are, however, permitted to terminate an employee for cause without penalty pursuant to the employment agreement. If the named executive officer is not terminated for cause, the Company will pay the remaining portion of the executive officer'sofficer’s salary.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Except for the ownership of our securities, and except as set forth below, none of the directors, executive officers, holders of more than five percent of our outstanding Common Stock,common stock, or any member of the immediate family of any such person have, to our knowledge, had a material interest, direct or indirect, in any transaction or proposed transaction which may materially affect our company.

Secured Loan Agreements

On November 20, 2015, weSeptember 16, 2019, Hong Kong Takung entered into an interest-free loan agreement (the "HK Dollar Working Capital Loan") with Mr. Shuhai Li (“Li”), former legal representative of Tianjin Takung, for an amount of $6,448,784 (HK$50,000,000). The purpose of the loan is to provide Hong Kong Takung with sufficient Hong Kong Dollar-denominated currency to meet its working capital requirements with the maturity date of the loan as May 15, 2020. On May 15, 2020, Hong Kong Takung entered into an extension agreement with Li to extend the HK Dollar Working Capital Loan with a Consulting Agreementdue date on May 15, 2021. On May 29, 2020, Li transferred this loan to Jing Wang (“Wang”), our Chief Financial Officer with Regenerationthe same extended maturity date.

In the meantime, Tianjin Takung entered into an interest-free loan agreement (the "RMB Working Capital Group, LLCLoan") with Li for the provisionloan of certain consulting$6,225,134 (RMB40,619,000) with the maturity date of the loan as May 15, 2020. On May 15, 2020, Tianjin Takung entered into an extension agreement with Li to extend the RMB Working Capital Loan with a maturity date on May 15, 2021. On May 29, 2020, the loan was transferred to Wang.

Through an understanding between Wang and advisory services, including without limitation, assisting in the preparation of Company financial projections, business plans, executive summaries and website, and recruiting qualified directors and officers. In consideration for providing such services, the Company, issued to Regenerationthe HK Dollar Working Capital Group, LLC 487,000 restricted sharesLoan is "secured" by the RMB Working Capital Loan. It is the understanding between the parties that the HK Dollar Working Capital Loan and the RMB Working Capital Loan will be repaid simultaneously.

Lease Agreements

We signed a new Hong Kong office lease on December 15, 2020 for approximately 885 square feet of Common Stock (the “Compensation Shares”) which are placed inoffice space at Room 709 on the 7th floor of Tower II of Admiralty Centre, 18 Harcourt Road, Admiralty, Hong Kong. The lease expires on December 14, 2022 and provides for a monthly rent of $5,135 (HK$39,825) and a monthly building management fee of $575 (HK$4,460).

On August 12, 2020, Tianjin Takung leased an escrow account maintained with the Company’s attorneys until either (i)office space at 14-1-302, Intercity Meijing Garden, Beichen Economic Development Zone, Beichen District, Tianjin, China. The lease provides a monthly rent payment is $227(RMB1,568) and expires on August 11, 2021.

Consulting Agreements

On August 1, 2019, the Company has successfully listed its securitiesengaged Chun Hin Leslie Chow as an external consultant after his resignation as the Company’s Chief Executive Officer and accrued a monthly service fee of $11,398 (HK$88,400). The service agreement is renewable annually. The agreement was renewed on the NASDAQ or other U.S. securities exchange on or before March 31, 2017, whereupon the Compensation Shares shall be forthwith delivered to Regeneration or (ii) ifAugust 1, 2020 with a monthly service fee of $7,736 (HK$60,000).

On September 16, 2020, the Company is unsuccessful in listing its securitiesengaged Fang Mu as an external consultant after her resignation as the Company’s Chief Executive Officer and accrued a monthly service fee of $5,157 (HK$40,000) with an expiration date on the NASDAQ or other U.S. securities exchange on or before March 31, 2017, the Compensation Shares shall be returned to the Company for cancellation. Regeneration Capital Group, LLC shall be entitled to “piggy-back” registration rights with respect to the Compensation Shares.September 15, 2021.

OtherProcedures for Approval of Related Party Transactions of Hong Kong Operating Entity and Shanghai Operating Entity

Related Transactions Prior to Reverse-Merger

Except as disclosed above, no executive officer, director or any member of these individuals’ immediate families, any corporation or organization with whom any of these individuals is an affiliate or any trust or estate in which any of these individuals serve as a trustee or in a similar capacity or has a substantial beneficial interest in is or has been indebted to us at any time since the beginning of our fiscal year 2015.

PROCEDURES FOR APPROVAL OF RELATED PARTY TRANSACTIONS

Our Board of Directors is charged with reviewing and approving all potential related party transactions. All such related party transactions must then be reported under applicable SEC rules. We have not adopted other procedures for review, or standards for approval, of such transactions, but instead review them on a case-by-case basis.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEDirector Independence

NYSE listing standards require that a majority of our board of directors be independent. An “independent director” is defined generally as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship which in the opinion of the company’s board of directors, would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Our board of directors has determined that Mr. Doug Buerger, Mr. Tak Ching (Anthony) Poon and Mr. Ronggang (Jonathan) Zhang are “independent directors” as defined in the NYSE listing standards and applicable SEC rules. Our independent directors have regularly scheduled meetings at which only independent directors are present.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors and persons who own more than 10% of a registered class of our equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of our common stock and other equity securities, on Form 3, 4 and 5 respectively. Executive officers, directors and greater than 10% shareholders are required by the SEC regulations to furnish our Company with copies of all Section 16(a) reports they file.

Based solely on our review of the copies of such reports received by us and on written representations by our officers and directors regarding their compliance with the applicable reporting requirements under Section 16(a) of the Exchange Act, we believe that, with respect to the fiscal year ended December 31, 2016,2020, our officers and directors, and all of the persons known to us to own more than 10% of our Common Stock,common stock, filed all required reports on a timely basis.basis, save that one officer who filed an erroneous report, which has since been rectified.

AUDIT COMMITTEE REPORT

The Audit Committee has furnished the following report on its activities during the fiscal year ended December 31, 2016.2020. The report is not deemed to be “soliciting material” or “filed” with the SEC or subject to the SEC’s proxy rules or to the liabilities of Section 18 of the Exchange Act, and the report shall not be deemed to be incorporated by reference into any prior or subsequent filing under the Securities Act or the Exchange Act except to the extent that the Company specifically incorporates it by reference into any such filing. The Audit Committee charter sets forth the responsibilities of the Audit Committee. A copy of the Audit Committee charter is available on our website athttp:// content. stockpr.com/takungae/db/225/642/file/Audit+Committee+Charter+-+v443235_TAKUNG_ART_CO.%2C_LTD._ 8K_20160623+-+99.1.pdf.www.takungart.com/investors/corporate-governance/governance-docs.

The primary function of the Audit Committee is to assist the Board in its oversight and monitoring of our financial reporting and auditing process. Management has primary responsibility for our financial statements and the overall reporting process, including maintaining effective internal control over financial reporting and assessing the effectiveness of our system of internal controls. The independent registered public accounting firm audits the annual financial statements prepared by management, expresses an opinion as to whether those financial statements fairly present our financial position, results of operations and cash flows in conformity with U.S. generally accepted accounting principles, and discusses with the Audit Committee any issues they believe should be raised with the Audit Committee. These discussions include a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements. The Audit Committee monitors our processes, relying, without independent verification, on the information provided to it and on the representations made by management and the independent registered public accounting firm.

The Audit Committee has reviewed and discussed the audited financial statements with our management and representatives of Marcum Bernstein & Pinchuk LLP (“Marcum”),WWC, our independent registered public accounting firm. The Audit Committee has discussed Marcum’sWWC’s judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Audit Committee by Statement on Auditing Standards No. 114 (which superseded Statement on Auditing Standards No. 61), other standards of the Public Company Accounting Oversight Board (United States), rules of the SEC, and other applicable regulations. The Audit Committee also received the written disclosures and the letter from MarcumWWC required by applicable requirements of the Public Company Accounting Oversight Board regarding the firm’s independence from our management and has discussed with Marcum its independence. The members of the Audit Committee considered whether the services provided by Marcum, for the year ended December 31, 2016, are compatible with maintainingWWC its independence. The Board has delegated to the Audit Committee the authority to approve the engagement of our independent registered public accounting firm.

Based upon its reviews and discussions, the Audit Committee recommended to our Board that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 20162020 for filing with the SEC and the Board approved that recommendation.

| /s/ | |

| /s/ | |

| September 30, 2021 | /s/ |

September 5, 2017

SUBMISSION OF SHAREHOLDER PROPOSALS

If you wish to have a proposal included in our proxy statement and form of proxy for next year’s annual meeting in accordance with Rule 14a-8 under the Exchange Act, your proposal must be received by us at our principal executive office on or before June 18, 2017.September 11, 2022. A proposal which is received after that date or which otherwise fails to meet the requirements for shareholder proposals established by the SEC will not be included. The submission of a shareholder proposal does not guarantee that it will be included in the proxy statement.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We have filed reports, proxy statements and other information with the SEC. You may read and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.W., Washington, D.C. 20549. You may obtain information on the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains the reports, proxy statements and other information we file electronically with the SEC. The address of the SEC website iswww.sec.gov.

You may request, and we will provide at no cost, a copy of these filings, including any exhibits to such filings, by writing or telephoning us at the following address: Di Xiao,Kwok Leung Li, our Chief Executive Officer, located at Flat/RM 03-04 20/F Hutchison House 10Room 709 Tower 2, Admiralty Centre18, Harcourt Road, Central,Admiralty, Hong Kong. You may also access these filings at our web site under the investor relations link athttp://www.takungart.com/ir.takungart.com/all-sec-filings.all-sec-filings.html

ANNUAL REPORT

A copy of the Company’s Annual Report on Form 10-K for fiscal year ended December 31, 2016, which has been filed with the SEC pursuant to the Exchange Act, is included with this proxy statement. Additional copies of this proxy statement and/or the Annual Report as well as copies of any Quarterly Reporton Form 10-K for the fiscal year ended December 31, 2020 may be obtained without charge upon written request to Takung Art CO.Co., Ltd, at Flat/RM 03-04 20/F Hutchison House 10Room 709 Tower 2, Admiralty Centre18, Harcourt Road, Central,Admiralty, Hong Kong, or on the SEC’s internet website atwww.sec.gov.

YOUR VOTE IS IMPORTANT

You are cordially invited to attend the Annual Meeting. However, to ensure that your shares are represented at the meeting, please submit your proxy or voting instructions. Please see the instructions on the proxy and voting instruction card. Submitting a proxy or voting instructions will not prevent you from attending the Annual Meeting and voting in person, if you so desire, but will help the Company secure a quorum and reduce the expense of additional proxy solicitation.

| December 8, 2021 | |

| Chief Executive Office |

Annex A

TAKUNG ART CO., LTD

AMENDED AND RESTATED 2015 INCENTIVE STOCK PLAN

This TAKUNG ART CO., LTD AMENDED AND RESTATED 2015 Incentive Stock Plan (the "Plan") is designed to retain directors, executives and selected employees and consultants and reward them for making major contributions to the success of the Company. These objectives are accomplished by making long-term incentive awards under the Plan thereby providing Participants with a proprietary interest in the growth and performance of the Company.

| 1. | Definitions. |

| (a) | "Board" - The Board of Directors of the Company. |

| (b) | "Code" - The Internal Revenue Code of 1986, as amended from time to time. |

| (c) | "Committee" - The Compensation Committee of the Company's Board, or such other committee of the Board that is designated by the Board to administer the Plan, composed of not less than two members of the Board all of whom are disinterested persons, as contemplated by Rule 16b-3 ("Rule 16b-3") promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). |

| (d) | "Company" – Takung Art Co., Ltd . and its subsidiaries, including subsidiaries of subsidiaries. |

(e) (f) | "Delaware Securities Rules" – Title VI, Chapter 73 of the Delaware Code. "Exchange Act" - The Securities Exchange Act of 1934, as amended from time to time. |

| (g) | "Fair Market Value" - The fair market value of the Company's issued and outstanding Stock as determined in good faith by the Board or Committee. |

| (h) | "Grant" - The grant of any form of stock option, stock award, or stock purchase offer, whether granted singly, in combination or in tandem, to a Participant pursuant to such terms, conditions and limitations as the Committee may establish in order to fulfill the objectives of the Plan. |

| (i) | "Grant Agreement" - An agreement between the Company and a Participant that sets forth the terms, conditions and limitations applicable to a Grant. |

| (j) | "Option" - Either an Incentive Stock Option, in accordance with Section 422 of the Code, or a Nonstatutory Option, to purchase the Company's Stock that may be awarded to a Participant under the Plan. A Participant who receives an award of an Option shall be referred to as an "Optionee." |

| (k) | "Participant" - A director, officer, employee or consultant of the Company to whom an Award has been made under the Plan. |

| (l) | "Restricted Stock Purchase Offer" - A Grant of the right to purchase a specified number of shares of Stock pursuant to a written agreement issued under the Plan. |

| (m) | "Securities Act" - The Securities Act of 1933, as amended from time to time. |

| (n) | "Stock" - Authorized and issued or unissued shares of common stock of the Company. | |

| (o) | "Stock Award" - A Grant made under the Plan in stock or denominated in units of stock for which the Participant is not obligated to pay additional consideration. |

| 2. | Administration. |

The Plan shall be administered by the Board, provided however, that the Board may delegate such administration to the Committee. Subject to the provisions of the Plan, the Board and/or the Committee shall have authority to (a) grant, in its discretion, Incentive Stock Options in accordance with Section 422 of the Code, or Nonstatutory Options, Stock Awards or Restricted Stock Purchase Offers; (b) determine in good faith the fair market value of the Stock covered by any Grant; (c) determine which eligible persons shall receive Grants and the number of shares, restrictions, terms and conditions to be included in such Grants; (d) construe and interpret the Plan; (e) promulgate, amend and rescind rules and regulations relating to its administration, and correct defects, omissions and inconsistencies in the Plan or any Grant; (f) consistent with the Plan and with the consent of the Participant, as appropriate, amend any outstanding Grant or amend the exercise date or dates thereof; (g) determine the duration and purpose of leaves of absence which may be granted to Participants without constituting termination of their employment for the purpose of the Plan or any Grant; and (h) make all other determinations necessary or advisable for the Plan's administration. The interpretation and construction by the Board of any provisions of the Plan or selection of Participants shall be conclusive and final. No member of the Board or the Committee shall be liable for any action or determination made in good faith with respect to the Plan or any Grant made thereunder.

| 3. | Eligibility. |

| (a) | General: The persons who shall be eligible to receive Grants shall be directors, officers, employees or consultants to the Company. The term consultant shall mean any person, other than an employee, who is engaged by the Company to render services and is compensated for such services. An Optionee may hold more than one Option. Any issuance of a Grant to an officer or director of the Company subsequent to the first registration of any of the securities of the Company under the Exchange Act shall comply with the requirements of Rule 16b-3. |

| (b) | Incentive Stock Options: Incentive Stock Options may only be issued to employees of the Company. Incentive Stock Options may be granted to officers or directors, provided they are also employees of the Company. Payment of a director's fee shall not be sufficient to constitute employment by the Company. |

The Company shall not grant an Incentive Stock Option under the Plan to any employee if such Grant would result in such employee holding the right to exercise for the first time in any one calendar year, under all Incentive Stock Options granted under the Plan or any other plan maintained by the Company, with respect to shares of Stock having an aggregate Fair Market Value, determined as of the date of the Option is granted, in excess of $100,000. Should it be determined that an Incentive Stock Option granted under the Plan exceeds such maximum for any reason other than a failure in good faith to value the Stock subject to such option, the excess portion of such option shall be considered a Nonstatutory Option. To the extent the employee holds two (2) or more such Options which become exercisable for the first time in the same calendar year, the foregoing limitation on the exercisability of such Option as Incentive Stock Options under the Federal tax laws shall be applied on the basis of the order in which such Options are granted. If, for any reason, an entire Option does not qualify as an Incentive Stock Option by reason of exceeding such maximum, such Option shall be considered a Nonstatutory Option.

| (c) | Nonstatutory Option: The provisions of the foregoing Section 3(b) shall not apply to any Option designated as a "Nonstatutory Option" or which sets forth the intention of the parties that the Option be a Nonstatutory Option. |

| (d) | Stock Awards and Restricted Stock Purchase Offers: The provisions of this Section 3 shall not apply to any Stock Award or Restricted Stock Purchase Offer under the Plan. |

| 4. | Stock. |

| (a) | Authorized Stock: Stock subject to Grants may be either unissued or reacquired Stock. |

| (b) | Number of Shares: Subject to adjustment as provided in Section 5(i) of the Plan, the total number of shares of Stock which may be purchased or granted directly by Options, Stock Awards or Restricted Stock Purchase Offers, or purchased indirectly through exercise of Options granted under the Plan shall not exceed 1,502,690. If any Grant shall for any reason terminate or expire, any shares allocated thereto but remaining unpurchased upon such expiration or termination shall again be available for Grants with respect thereto under the Plan as though no Grant had previously occurred with respect to such shares. Any shares of Stock issued pursuant to a Grant and repurchased pursuant to the terms thereof shall be available for future Grants as though not previously covered by a Grant. |

| (c) | Reservation of Shares: The Company shall reserve and keep available at all times during the term of the Plan such number of shares as shall be sufficient to satisfy the requirements of the Plan. If, after reasonable efforts, which efforts shall not include the registration of the Plan or Grants under the Securities Act, the Company is unable to obtain authority from any applicable regulatory body, which authorization is deemed necessary by legal counsel for the Company for the lawful issuance of shares hereunder, the Company shall be relieved of any liability with respect to its failure to issue and sell the shares for which such requisite authority was so deemed necessary unless and until such authority is obtained. |

| (d) | Application of Funds: The proceeds received by the Company from the sale of Stock pursuant to the exercise of Options or rights under Stock Purchase Agreements will be used for general corporate purposes. |

| (e) | No Obligation to Exercise: The issuance of a Grant shall impose no obligation upon the Participant to exercise any rights under such Grant. |

| 5. | Terms and Conditions of Options. |

Options granted hereunder shall be evidenced by agreements between the Company and the respective Optionees, in such form and substance as the Board or Committee shall from time to time approve. The form of Incentive Stock Option Agreement attached hereto as Exhibit A and the three forms of a Nonstatutory Stock Option Agreement for employees, for directors and for consultants, attached hereto as Exhibit B-1,Exhibit B-2 and Exhibit B-3, respectively, shall be deemed to be approved by the Board. Option agreements need not be identical, and in each case may include such provisions as the Board or Committee may determine, but all such agreements shall be subject to and limited by the following terms and conditions:

| (a) | Number of Shares: Each Option shall state the number of shares to which it pertains. |

| (b) | Exercise Price: Each Option shall state the exercise price, which shall be determined as follows: |

| (i) | Any Incentive Stock Option granted to a person who at the time the Option is granted owns (or is deemed to own pursuant to Section 424(d) of the Code) stock possessing more than ten percent (10%) of the total combined voting power or value of all classes of stock of the Company ("Ten Percent Holder") shall have an exercise price of no less than 110% of Fair Market Value as of the date of grant; and |

| (ii) | Incentive Stock Options granted to a person who at the time the Option is granted is not a Ten Percent Holder shall have an exercise price of no less than 100% of Fair Market Value as of the date of grant. |

For the purposes of this Section 5(b), the Fair Market Value shall be as determined by the Board in good faith, which determination shall be conclusive and binding; provided however, that if there is a public market for such Stock, the Fair Market Value per share shall be the average of the bid and asked prices (or the closing price if such stock is listed on the NASDAQ National Market System or Small Cap Issue Market) on the date of grant of the Option, or if listed on a stock exchange, the closing price on such exchange on such date of grant.

| (c) | Medium and Time of Payment: The exercise price shall become immediately due upon exercise of the Option and shall be paid in cash or check made payable to the Company. Should the Company's outstanding Stock be registered under Section 12(g) of the Exchange Act at the time the Option is exercised, then the exercise price may also be paid as follows: |

| (i) | in shares of Stock held by the Optionee for the requisite period necessary to avoid a charge to the Company's earnings for financial reporting purposes and valued at Fair Market Value on the exercise date, or | |

| (ii) | through a special sale and remittance procedure pursuant to which the Optionee shall concurrently provide irrevocable written instructions (a) to a Company designated brokerage firm to effect the immediate sale of the purchased shares and remit to the Company, out of the sale proceeds available on the settlement date, sufficient funds to cover the aggregate exercise price payable for the purchased shares plus all applicable Federal, state and local income and employment taxes required to be withheld by the Company by reason of such purchase and (b) to the Company to deliver the certificates for the purchased shares directly to such brokerage firm in order to complete the sale transaction. |

At the discretion of the Board, exercisable either at the time of Option grant or of Option exercise, the exercise price may also be paid (i) by Optionee's delivery of a promissory note in form and substance satisfactory to the Company and permissible under the Securities Rules of the State of Delaware and bearing interest at a rate determined by the Board in its sole discretion, but in no event less than the minimum rate of interest required to avoid the imputation of compensation income to the Optionee under the Federal tax laws, or (ii) in such other form of consideration permitted by the Delaware corporations law as may be acceptable to the Board.

| (d) | Term and Exercise of Options: |

Any Option granted to an employee, consultant or director of the Company shall become exercisable over a period of no longer than ten (10) years. Unless otherwise specified by the Board or the Committee in the resolution authorizing such Option, the date of grant of an Option shall be deemed to be the date upon which the Board or the Committee authorizes the granting of such Option. Each Option shall be exercisable to the nearest whole share, in installments or otherwise, as the respective Option agreements may provide. During the lifetime of an Optionee, the Option shall be exercisable only by the Optionee and shall not be assignable or transferable by the Optionee, and no other person shall acquire any rights therein. To the extent not exercised, installments (if more than one) shall accumulate, but shall be exercisable, in whole or in part, only during the period for exercise as stated in the Option agreement, whether or not other installments are then exercisable.

| (e) | Termination of Status as Employee, Consultant or Director: If Optionee's status as an employee shall terminate for any reason other than Optionee's disability or death, then Optionee (or if the Optionee shall die after such termination, but prior to exercise, Optionee's personal representative or the person entitled to succeed to the Option) shall have the right to exercise the portions of any of Optionee's Incentive Stock Options which were exercisable as of the date of such termination, in whole or in part, not less than 30 days nor more than three (3) months after such termination (or, in the event of "termination for good cause" as that term is defined in Delaware case law related thereto, or by the terms of the Plan or the Option Agreement or an employment agreement, the Option shall automatically terminate as of the termination of employment as to all shares covered by the Option). |

With respect to Nonstatutory Options granted to employees, directors or consultants, the Board may specify such period for exercise, not less than 30 days after such termination (except that in the case of "termination for cause" or removal of a director, the Option shall automatically terminate as of the termination of employment or services as to shares covered by the Option, following termination of employment or services as the Board deems reasonable and appropriate). The Option may be exercised only with respect to installments that the Optionee could have exercised at the date of termination of employment or services. Nothing contained herein or in any Option granted pursuant hereto shall be construed to affect or restrict in any way the right of the Company to terminate the employment or services of an Optionee with or without cause.

| (f) | Disability of Optionee: If an Optionee is disabled (within the meaning of Section 22(e)(3) of the Code) at the time of termination, the three (3) month period set forth in Section 5(e) shall be a period, as determined by the Board and set forth in the Option, of not less than six months nor more than one year after such termination. | |

| (g) | Death of Optionee: If an Optionee dies while employed by, engaged as a consultant to, or serving as a Director of the Company, the portion of such Optionee's Option which was exercisable at the date of death may be exercised, in whole or in part, by the estate of the decedent or by a person succeeding to the right to exercise such Option at any time within (i) a period, as determined by the Board and set forth in the Option, of not less than six (6) months nor more than one (1) year after Optionee's death, which period shall not be more, in the case of a Nonstatutory Option, than the period for exercise following termination of employment or services, or (ii) during the remaining term of the Option, whichever is the lesser. The Option may be so exercised only with respect to installments exercisable at the time of Optionee's death and not previously exercised by the Optionee. |

| (h) | Nontransferability of Option: No Option shall be transferable by the Optionee, except by will or by the laws of descent and distribution. |

| (i) | Recapitalization: Subject to any required action of shareholders, the number of shares of Stock covered by each outstanding Option, and the exercise price per share thereof set forth in each such Option, shall be proportionately adjusted for any increase or decrease in the number of issued shares of Stock of the Company resulting from a stock split, stock dividend, combination, subdivision or reclassification of shares, or the payment of a stock dividend, or any other increase or decrease in the number of such shares affected without receipt of consideration by the Company; provided, however, the conversion of any convertible securities of the Company shall not be deemed to have been "effected without receipt of consideration" by the Company. |

In the event of a proposed dissolution or liquidation of the Company, a merger or consolidation in which the Company is not the surviving entity, or a sale of all or substantially all of the assets or capital stock of the Company (collectively, a "Reorganization"), unless otherwise provided by the Board, this Option shall terminate immediately prior to such date as is determined by the Board, which date shall be no later than the consummation of such Reorganization. In such event, if the entity which shall be the surviving entity does not tender to Optionee an offer, for which it has no obligation to do so, to substitute for any unexercised Option a stock option or capital stock of such surviving of such surviving entity, as applicable, which on an equitable basis shall provide the Optionee with substantially the same economic benefit as such unexercised Option, then the Board may grant to such Optionee, in its sole and absolute discretion and without obligation, the right for a period commencing thirty (30) days prior to and ending immediately prior to the date determined by the Board pursuant hereto for termination of the Option or during the remaining term of the Option, whichever is the lesser, to exercise any unexpired Option or Options without regard to the installment provisions of Paragraph 6(d) of the Plan; provided, that any such right granted shall be granted to all Optionees not receiving an offer to receive substitute options on a consistent basis, and provided further, that any such exercise shall be subject to the consummation of such Reorganization.

Subject to any required action of shareholders, if the Company shall be the surviving entity in any merger or consolidation, each outstanding Option thereafter shall pertain to and apply to the securities to which a holder of shares of Stock equal to the shares subject to the Option would have been entitled by reason of such merger or consolidation.

In the event of a change in the Stock of the Company as presently constituted, which is limited to a change of all of its authorized shares without par value into the same number of shares with a par value, the shares resulting from any such change shall be deemed to be the Stock within the meaning of the Plan.

To the extent that the foregoing adjustments relate to stock or securities of the Company, such adjustments shall be made by the Board, whose determination in that respect shall be final, binding and conclusive. Except as expressly provided in this Section 5(i), the Optionee shall have no rights by reason of any subdivision or consolidation of shares of stock of any class or the payment of any stock dividend or any other increase or decrease in the number of shares of stock of any class, and the number or price of shares of Stock subject to any Option shall not be affected by, and no adjustment shall be made by reason of, any dissolution, liquidation, merger, consolidation or sale of assets or capital stock, or any issue by the Company of shares of stock of any class or securities convertible into shares of stock of any class.

The Grant of an Option pursuant to the Plan shall not affect in any way the right or power of the Company to make any adjustments, reclassifications, reorganizations or changes in its capital or business structure or to merge, consolidate, dissolve, or liquidate or to sell or transfer all or any part of its business or assets.

| (j) | Rights as a Shareholder: An Optionee shall have no rights as a shareholder with respect to any shares covered by an Option until the effective date of the issuance of the shares following exercise of such Option by Optionee. No adjustment shall be made for dividends (ordinary or extraordinary, whether in cash, securities or other property) or distributions or other rights for which the record date is prior to the date such stock certificate is issued, except as expressly provided in Section 5(i) hereof. |

| (k) | Modification, Acceleration, Extension, and Renewal of Options: Subject to the terms and conditions and within the limitations of the Plan, the Board may modify an Option, or, once an Option is exercisable, accelerate the rate at which it may be exercised, and may extend or renew outstanding Options granted under the Plan or accept the surrender of outstanding Options (to the extent not theretofore exercised) and authorize the granting of new Options in substitution for such Options, provided such action is permissible under Section 422 of the Code and the Delaware Securities Rules. Notwithstanding the provisions of this Section 5(k), however, no modification of an Option shall, without the consent of the Optionee, alter to the Optionee's detriment or impair any rights or obligations under any Option theretofore granted under the Plan. |

| (l) | Exercise Before Exercise Date: At the discretion of the Board, the Option may, but need not, include a provision whereby the Optionee may elect to exercise all or any portion of the Option prior to the stated exercise date of the Option or any installment thereof. Any shares so purchased prior to the stated exercise date shall be subject to repurchase by the Company upon termination of Optionee's employment as contemplated by Section 5(n) hereof prior to the exercise date stated in the Option and such other restrictions and conditions as the Board or Committee may deem advisable. |

| (m) | Other Provisions: The Option agreements authorized under the Plan shall contain such other provisions, including, without limitation, restrictions upon the exercise of the Options, as the Board or the Committee shall deem advisable. Shares shall not be issued pursuant to the exercise of an Option, if the exercise of such Option or the issuance of shares thereunder would violate, in the opinion of legal counsel for the Company, the provisions of any applicable law or the rules or regulations of any applicable governmental or administrative agency or body, such as the Code, the Securities Act, the Exchange Act, the Delaware Securities Rules, Delaware corporation law, and the rules promulgated under the foregoing or the rules and regulations of any exchange upon which the shares of the Company are listed. Without limiting the generality of the foregoing, the exercise of each Option shall be subject to the condition that if at any time the Company shall determine that (i) the satisfaction of withholding tax or other similar liabilities, or (ii) the listing, registration or qualification of any shares covered by such exercise upon any securities exchange or under any state or federal law, or (iii) the consent or approval of any regulatory body, or (iv) the perfection of any exemption from any such withholding, listing, registration, qualification, consent or approval is necessary or desirable in connection with such exercise or the issuance of shares thereunder, then in any such event, such exercise shall not be effective unless such withholding, listing registration, qualification, consent, approval or exemption shall have been effected, obtained or perfected free of any conditions not acceptable to the Company. |

| (n) | Repurchase Agreement: The Board may, in its discretion, require as a condition to the Grant of an Option hereunder, that an Optionee execute an agreement with the Company, in form and substance satisfactory to the Board in its discretion ("Repurchase Agreement"), (i) restricting the Optionee's right to transfer shares purchased under such Option without first offering such shares to the Company or another shareholder of the Company upon the same terms and conditions as provided therein; and (ii) providing that upon termination of Optionee's employment with the Company, for any reason, the Company (or another shareholder of the Company, as provided in the Repurchase Agreement) shall have the right at its discretion (or the discretion of such other shareholders) to purchase and/or redeem all such shares owned by the Optionee on the date of termination of his or her employment at a price equal to: (A) the fair value of such shares as of such date of termination; or (B) if such repurchase right lapses at 20% of the number of shares per year, the original purchase price of such shares, and upon terms of payment permissible under the Delaware Securities Rules; provided that in the case of Options or Stock Awards granted to officers, directors, consultants or affiliates of the Company, such repurchase provisions may be subject to additional or greater restrictions as determined by the Board or Committee. |

| 6. | Stock Awards and Restricted Stock Purchase Offers. |

| (a) | Types of Grants. |

| (i) | Stock Award. All or part of any Stock Award under the Plan may be subject to conditions established by the Board or the Committee, and set forth in the Stock Award Agreement, which may include, but are not limited to, continuous service with the Company, achievement of specific business objectives, increases in specified indices, attaining growth rates and other comparable measurements of Company performance. Such Awards may be based on Fair Market Value or other specified valuation. All Stock Awards will be made pursuant to the execution of a Stock Award Agreement substantially in the form attached hereto as Exhibit C. |

| (ii) | Restricted Stock Purchase Offer. A Grant of a Restricted Stock Purchase Offer under the Plan shall be subject to such (i) vesting contingencies related to the Participant's continued association with the Company for a specified time and (ii) other specified conditions as the Board or Committee shall determine, in their sole discretion, consistent with the provisions of the Plan. All Restricted Stock Purchase Offers shall be made pursuant to a Restricted Stock Purchase Offer substantially in the form attached hereto as Exhibit D. |

| (b) | Conditions and Restrictions. Shares of Stock which Participants may receive as a Stock Award under a Stock Award Agreement or Restricted Stock Purchase Offer under a Restricted Stock Purchase Offer may include such restrictions as the Board or Committee, as applicable, shall determine, including restrictions on transfer, repurchase rights, right of first refusal, and forfeiture provisions. When transfer of Stock is so restricted or subject to forfeiture provisions it is referred to as "Restricted Stock". Further, with Board or Committee approval, Stock Awards or Restricted Stock Purchase Offers may be deferred, either in the form of installments or a future lump sum distribution. The Board or Committee may permit selected Participants to elect to defer distributions of Stock Awards or Restricted Stock Purchase Offers in accordance with procedures established by the Board or Committee to assure that such deferrals comply with applicable requirements of the Code including, at the choice of Participants, the capability to make further deferrals for distribution after retirement. Any deferred distribution, whether elected by the Participant or specified by the Stock Award Agreement, Restricted Stock Purchase Offers or by the Board or Committee, may require the payment be forfeited in accordance with the provisions of Section 6(c). Dividends or dividend equivalent rights may be extended to and made part of any Stock Award or Restricted Stock Purchase Offers denominated in Stock or units of Stock, subject to such terms, conditions and restrictions as the Board or Committee may establish. | ||

| (c) | Cancellation and Rescission of Grants. Unless the Stock Award Agreement or Restricted Stock Purchase Offer specifies otherwise, the Board or Committee, as applicable, may cancel any unexpired, unpaid, or deferred Grants at any time if the Participant is not in compliance with all other applicable provisions of the Stock Award Agreement or Restricted Stock Purchase Offer, the Plan and with the following conditions: | ||

| (i) | A Participant shall not render services for any organization or engage directly or indirectly in any business which, in the judgment of the chief executive officer of the Company or other senior officer designated by the Board or Committee, is or becomes competitive with the Company, or which organization or business, or the rendering of services to such organization or business, is or becomes otherwise prejudicial to or in conflict with the interests of the Company. For Participants whose employment has terminated, the judgment of the chief executive officer shall be based on the Participant's position and responsibilities while employed by the Company, the Participant's post-employment responsibilities and position with the other organization or business, the extent of past, current and potential competition or conflict between the Company and the other organization or business, the effect on the Company's customers, suppliers and competitors and such other considerations as are deemed relevant given the applicable facts and circumstances. A Participant who has retired shall be free, however, to purchase as an investment or otherwise, stock or other securities of such organization or business so long as they are listed upon a recognized securities exchange or traded over-the-counter, and such investment does not represent a substantial investment to the Participant or a greater than ten percent (10%) equity interest in the organization or business. |

| (ii) | A Participant shall not, without prior written authorization from the Company, disclose to anyone outside the Company, or use in other than the Company's business, any confidential information or material, as defined in the Company's Proprietary Information and Invention Agreement or similar agreement regarding confidential information and intellectual property, relating to the business of the Company, acquired by the Participant either during or after employment with the Company. |

| (iii) | A Participant, pursuant to the Company's Proprietary Information and Invention Agreement, shall disclose promptly and assign to the Company all right, title and interest in any invention or idea, patentable or not, made or conceived by the Participant during employment by the Company, relating in any manner to the actual or anticipated business, research or development work of the Company and shall do anything reasonably necessary to enable the Company to secure a patent where appropriate in the United States and in foreign countries. |

| (iv) | Upon exercise, payment or delivery pursuant to a Grant, the Participant shall certify on a form acceptable to the Committee that he or she is in compliance with the terms and conditions of the Plan. Failure to comply with all of the provisions of this Section 6(c) prior to, or during the six months after, any exercise, payment or delivery pursuant to a Grant shall cause such exercise, payment or delivery to be rescinded. The Company shall notify the Participant in writing of any such rescission within two years after such exercise, payment or delivery. Within ten days after receiving such a notice from the Company, the Participant shall pay to the Company the amount of any gain realized or payment received as a result of the rescinded exercise, payment or delivery pursuant to a Grant. Such payment shall be made either in cash or by returning to the Company the number of shares of Stock that the Participant received in connection with the rescinded exercise, payment or delivery. |

| (d) | Nonassignability. |

| (i) | Except pursuant to Section 6(e)(iii) and except as set forth in Section 6(d)(ii), no Grant or any other benefit under the Plan shall be assignable or transferable, or payable to or exercisable by, anyone other than the Participant to whom it was granted. |

| (ii) | Where a Participant terminates employment and retains a Grant pursuant to Section 6(e)(ii) in order to assume a position with a governmental, charitable or educational institution, the Board or Committee, in its discretion and to the extent permitted by law, may authorize a third party (including but not limited to the trustee of a "blind" trust), acceptable to the applicable governmental or institutional authorities, the Participant and the Board or Committee, to act on behalf of the Participant with regard to such Awards. |

| (e) | Termination of Employment. If the employment or service to the Company of a Participant terminates, other than pursuant to any of the following provisions under this Section 6(e), all unexercised, deferred and unpaid Stock Awards or Restricted Stock Purchase Offers shall be cancelled immediately, unless the Stock Award Agreement or Restricted Stock Purchase Offer provides otherwise: |

| (i) | Retirement Under a Company Retirement Plan. When a Participant's employment terminates as a result of retirement in accordance with the terms of a Company retirement plan, the Board or Committee may permit Stock Awards or Restricted Stock Purchase Offers to continue in effect beyond the date of retirement in accordance with the applicable Grant Agreement and the exercisability and vesting of any such Grants may be accelerated. |

| (ii) | Rights in the Best Interests of the Company. When a Participant resigns from the Company and, in the judgment of the Board or Committee, the acceleration and/or continuation of outstanding Stock Awards or Restricted Stock Purchase Offers would be in the best interests of the Company, the Board or Committee may (i) authorize, where appropriate, the acceleration and/or continuation of all or any part of Grants issued prior to such termination and (ii) permit the exercise, vesting and payment of such Grants for such period as may be set forth in the applicable Grant Agreement, subject to earlier cancellation pursuant to Section 9 or at such time as the Board or Committee shall deem the continuation of all or any part of the Participant's Grants are not in the Company's best interest. |

| (iii) | Death or Disability of a Participant. |

| (1) | In the event of a Participant's death, the Participant's estate or beneficiaries shall have a period up to the expiration date specified in the Grant Agreement within which to receive or exercise any outstanding Grant held by the Participant under such terms as may be specified in the applicable Grant Agreement. Rights to any such outstanding Grants shall pass by will or the laws of descent and distribution in the following order: (a) to beneficiaries so designated by the Participant; if none, then (b) to a legal representative of the Participant; if none, then (c) to the persons entitled thereto as determined by a court of competent jurisdiction. Grants so passing shall be made at such times and in such manner as if the Participant were living. |

| (2) | In the event a Participant is deemed by the Board or Committee to be unable to perform his or her usual duties by reason of mental disorder or medical condition which does not result from facts which would be grounds for termination for cause, Grants and rights to any such Grants may be paid to or exercised by the Participant, if legally competent, or a committee or other legally designated guardian or representative if the Participant is legally incompetent by virtue of such disability. |

| (3) | After the death or disability of a Participant, the Board or Committee may in its sole discretion at any time (1) terminate restrictions in Grant Agreements; (2) accelerate any or all installments and rights; and (3) instruct the Company to pay the total of any accelerated payments in a lump sum to the Participant, the Participant's estate, beneficiaries or representative; notwithstanding that, in the absence of such termination of restrictions or acceleration of payments, any or all of the payments due under the Grant might ultimately have become payable to other beneficiaries. |

| (4) | In the event of uncertainty as to interpretation of or controversies concerning this Section 6, the determinations of the Board or Committee, as applicable, shall be binding and conclusive. |

| 7. | Investment Intent. |

All Grants under the Plan are intended to be exempt from registration under the Securities Act provided by Section 4(2) thereunder. Unless and until the granting of Options or sale and issuance of Stock subject to the Plan are registered under the Securities Act or shall be exempt pursuant to the rules promulgated thereunder, each Grant under the Plan shall provide that the purchases or other acquisitions of Stock thereunder shall be for investment purposes and not with a view to, or for resale in connection with, any distribution thereof. Further, unless the issuance and sale of the Stock have been registered under the Securities Act, each Grant shall provide that no shares shall be purchased upon the exercise of the rights under such Grant unless and until (i) all then applicable requirements of state and federal laws and regulatory agencies shall have been fully complied with to the satisfaction of the Company and its counsel, and (ii) if requested to do so by the Company, the person exercising the rights under the Grant shall (i) give written assurances as to knowledge and experience of such person (or a representative employed by such person) in financial and business matters and the ability of such person (or representative) to evaluate the merits and risks of exercising the Option, and (ii) execute and deliver to the Company a letter of investment intent and/or such other form related to applicable exemptions from registration, all in such form and substance as the Company may require. If shares are issued upon exercise of any rights under a Grant without registration under the Securities Act, subsequent registration of such shares shall relieve the purchaser thereof of any investment restrictions or representations made upon the exercise of such rights.

| 8. | Amendment, Modification, Suspension or Discontinuance of the Plan. |

The Board may, insofar as permitted by law, from time to time, with respect to any shares at the time not subject to outstanding Grants, suspend or terminate the Plan or revise or amend it in any respect whatsoever, except that without the approval of the shareholders of the Company, no such revision or amendment shall (i) increase the number of shares subject to the Plan, (ii) decrease the price at which Grants may be granted, (iii) materially increase the benefits to Participants, or (iv) change the class of persons eligible to receive Grants under the Plan; provided, however, no such action shall alter or impair the rights and obligations under any Option, or Stock Award, or Restricted Stock Purchase Offer outstanding as of the date thereof without the written consent of the Participant thereunder. No Grant may be issued while the Plan is suspended or after it is terminated, but the rights and obligations under any Grant issued while the Plan is in effect shall not be impaired by suspension or termination of the Plan.

In the event of any change in the outstanding Stock by reason of a stock split, stock dividend, combination or reclassification of shares, recapitalization, merger, or similar event, the Board or the Committee may adjust proportionally (a) the number of shares of Stock (i) reserved under the Plan, (ii) available for Incentive Stock Options and Nonstatutory Options and (iii) covered by outstanding Stock Awards or Restricted Stock Purchase Offers; (b) the Stock prices related to outstanding Grants; and (c) the appropriate Fair Market Value and other price determinations for such Grants. In the event of any other change affecting the Stock or any distribution (other than normal cash dividends) to holders of Stock, such adjustments as may be deemed equitable by the Board or the Committee, including adjustments to avoid fractional shares, shall be made to give proper effect to such event. In the event of a corporate merger, consolidation, acquisition of property or stock, separation, reorganization or liquidation, the Board or the Committee shall be authorized to issue or assume stock options, whether or not in a transaction to which Section 424(a) of the Code applies, and other Grants by means of substitution of new Grant Agreements for previously issued Grants or an assumption of previously issued Grants.

| 9. | Tax Withholding. |

The Company shall have the right to deduct applicable taxes from any Grant payment and withhold, at the time of delivery or exercise of Options, Stock Awards or Restricted Stock Purchase Offers or vesting of shares under such Grants, an appropriate number of shares for payment of taxes required by law or to take such other action as may be necessary in the opinion of the Company to satisfy all obligations for withholding of such taxes. If Stock is used to satisfy tax withholding, such stock shall be valued based on the Fair Market Value when the tax withholding is required to be made.

| 10. | Availability of Information. |

During the term of the Plan and any additional period during which a Grant granted pursuant to the Plan shall be exercisable, the Company shall make available, not later than one hundred and twenty (120) days following the close of each of its fiscal years, such financial and other information regarding the Company as is required by the bylaws of the Company and applicable law to be furnished in an annual report to the shareholders of the Company.

| 11. | Notice. |

Any written notice to the Company required by any of the provisions of the Plan shall be addressed to the chief personnel officer or to the chief executive officer of the Company, and shall become effective when it is received by the office of the chief personnel officer or the chief executive officer.

| 12. | Indemnification of Board. |

In addition to such other rights or indemnifications as they may have as directors or otherwise, and to the extent allowed by applicable law, the members of the Board and the Committee shall be indemnified by the Company against the reasonable expenses, including attorneys' fees, actually and necessarily incurred in connection with the defense of any claim, action, suit or proceeding, or in connection with any appeal thereof, to which they or any of them may be a party by reason of any action taken, or failure to act, under or in connection with the Plan or any Grant granted thereunder, and against all amounts paid by them in settlement thereof (provided such settlement is approved by independent legal counsel selected by the Company) or paid by them in satisfaction of a judgment in any such claim, action, suit or proceeding, except in any case in relation to matters as to which it shall be adjudged in such claim, action, suit or proceeding that such Board or Committee member is liable for negligence or misconduct in the performance of his or her duties; provided that within sixty (60) days after institution of any such action, suit or Board proceeding the member involved shall offer the Company, in writing, the opportunity, at its own expense, to handle and defend the same.

| 13. | Governing Law. |

The Plan and all determinations made and actions taken pursuant hereto, to the extent not otherwise governed by the Code or the securities laws of the United States, shall be governed by the law of the State of Delaware and construed accordingly.

| 14. | Effective and Termination Dates. |

The Plan shall become effective on the date it is approved by the holders of a majority of the shares of Stock then outstanding. The Plan shall terminate ten (10) years later, subject to earlier termination by the Board pursuant to Section 8.

[SIGNATURE PAGE TO FOLLOW]

The foregoing Amended And Restated 2015 Incentive Stock Plan was duly adopted and approved by the Shareholders of the Company on December [*], 2021.

| TAKUNG ART CO., LTD | ||

| a Delaware corporation | ||

| By: | /s/ Kwok Leung Li | |

| Name: Kwok Leung Li | ||

| Title: Chief Executive Officer | ||

EXHIBIT A

TAKUNG ART CO., LTD

INCENTIVE STOCK OPTION AGREEMENT

This Incentive Stock Option Agreement ("Agreement") is made and entered into as of the date set forth below, by and between Takung Art Co., Ltd, a Delaware corporation (the "Company"), and the employee of the Company named in Section 1(b). ("Optionee"):

In consideration of the covenants herein set forth, the parties hereto agree as follows:

1. Option Information.

| Date of Option: |

| (b) | Optionee: |

| (c) | Number of Shares: |

| (d) | Exercise Price: |

2. Acknowledgements.

(a) Optionee is an employee of the Company.

(b) The Board of Directors (the "Board" which term shall include an authorized committee of the Board of Directors) and shareholders of the Company have heretofore adopted an amended and restated 2015 Incentive Stock Plan (the "Plan"), pursuant to which this Option is being granted.

(c) The Board has authorized the granting to Optionee of an incentive stock option ("Option") as defined in Section 422 of the Internal Revenue Code of 1986, as amended, (the "Code") to purchase shares of common stock of the Company ("Stock") upon the terms and conditions hereinafter stated and pursuant to an exemption from registration under the Securities Act of 1933, as amended (the "Securities Act") provided by Section 4(2) thereunder.

3. Shares; Price. The Company hereby grants to Optionee the right to purchase, upon and subject to the terms and conditions herein stated, the number of shares of Stock set forth in Section 1(c) above (the "Shares") for cash (or other consideration as is authorized under the Plan and acceptable to the Board, in their sole and absolute discretion) at the price per Share set forth in Section 1(d) above (the "Exercise Price"), such price being not less than the fair market value per share of the Shares covered by this Option as of the date hereof (unless Optionee is the owner of Stock possessing ten percent or more of the total voting power or value of all outstanding Stock of the Company, in which case the Exercise Price shall be no less than 110% of the fair market value of such Stock).

4. Term of Option; Continuation of Employment. This Option shall expire, and all rights hereunder to purchase the Shares shall terminate ____ (___) years from the date hereof. This Option shall earlier terminate subject to Sections 7 and 8 hereof upon, and as of the date of, the termination of Optionee's employment if such termination occurs prior to the end of such ____ (___) year period. Nothing contained herein shall confer upon Optionee the right to the continuation of his or her employment by the Company or to interfere with the right of the Company to terminate such employment or to increase or decrease the compensation of Optionee from the rate in existence at the date hereof.

5. Vesting of Option. Subject to the provisions of Sections 7 and 8 hereof, this Option shall become exercisable during the term of Optionee's employment in ______ equal annual installments of _______ percent of the Shares covered by this Option, the first installment to be exercisable on _______ anniversary of the date of this Option (the "Initial Vesting Date"), with an additional _____ percent of such Shares becoming exercisable on each of the successive periods following the Initial Vesting Date. The installments shall be cumulative (i.e., this option may be exercised, as to any or all Shares covered by an installment, at any time or times after an installment becomes exercisable and until expiration or termination of this option).

6. Exercise. This Option shall be exercised as follows: